Mention the Different Budgeting Periods and Explain Each

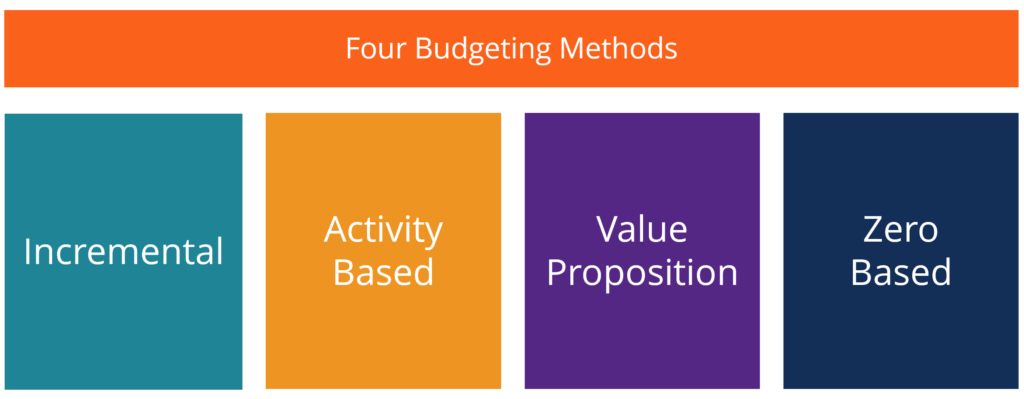

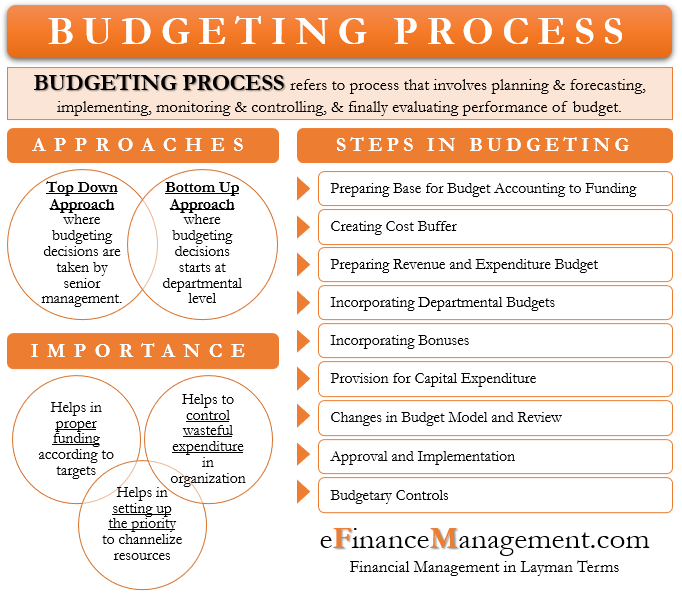

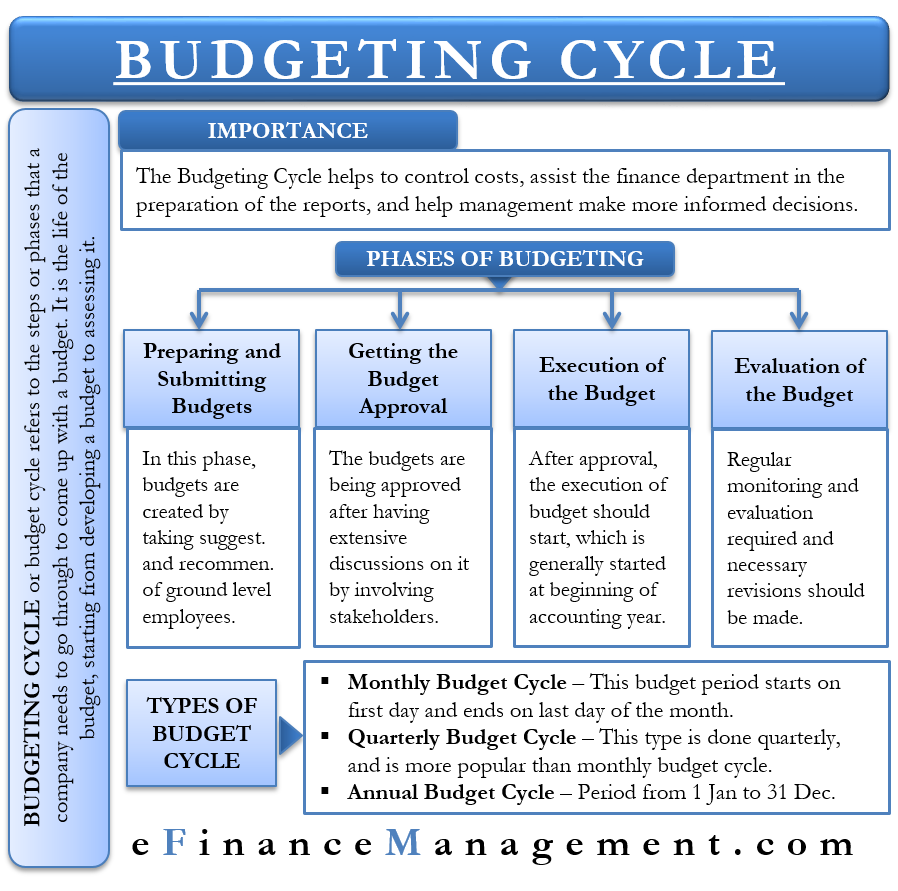

This process involves planning and forecasting implementing monitoring and controlling and finally evaluating the performance of the budget. The 5 most common approaches to budgeting.

Project Preparing Budget Proposal How To Create A Project Preparing Budget Proposal Download This Project P Proposal Templates Templates Schedule Templates

Up to 256 cash back Zero-based budgeting requires managers to build budgets from the ground up each year.

. 3 program and planning program budgeting. For example if a company prepares the budget quarterly then the budget period will be three months. A government budget is said to be a balanced budget if the estimated government expenditure is equal to expected government receipts in a.

The expense budget indicates all expected expenses of a firm for the coming year while the revenue budget shows all projected revenues for the coming year. Enacted Budget law. Mentioned below are brief explanations of these three types of budgets.

The change typically comes in percentage term and could either be an increase or a cutback depending on many factors primarily the organisations needs and situation. Each new level of management has responsibility for reviewing and negotiating any changes in. A MIRR in excel MIRR In Excel MIRR or modified internal rate of return in excel is an in-build financial function to calculate.

Some companies are preparing a budget for more than one year and some companies limit the period to one year. The process of zero-based budgeting starts from a zero base and every function. The budget period is the period of time during which you are authorized to spend the funds awarded and must meet the matching or cost-sharing requirement if any and is.

Example of Capital Budgeting. The budget period on the other hand is the actual period to which the budget applies. Zero-based budgeting ZBB is a method of budgeting in which all expenses must be justified for each new period.

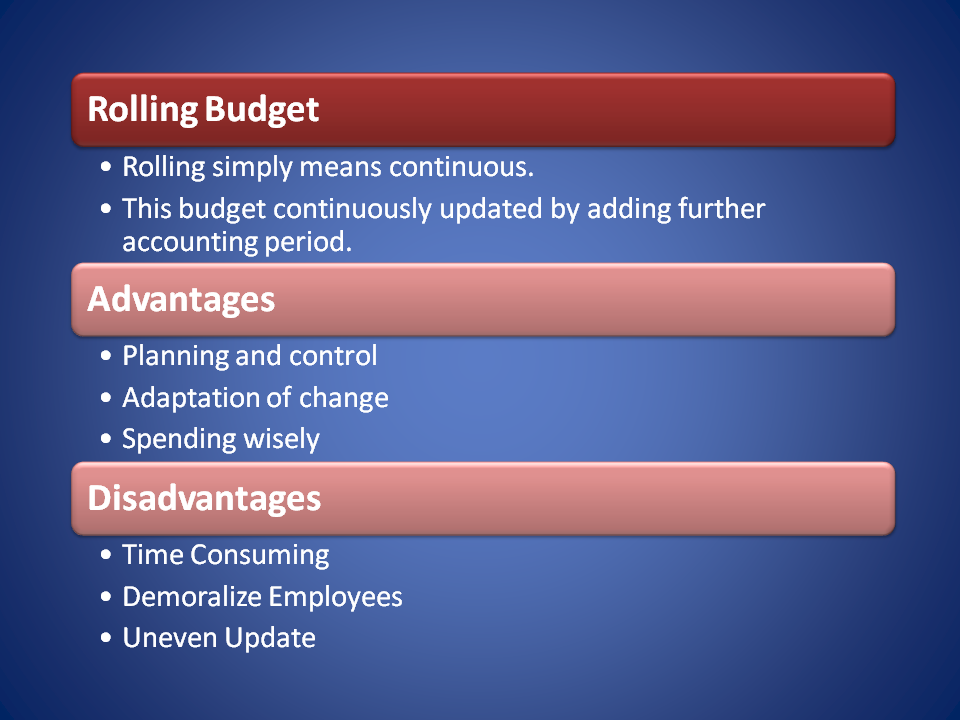

A regular month on month or quarter on quarter analysis of these reports helps in the. Various budgeting models continue to be commonly used and fall predominantly into the following categories. But the budget cycle will start before the quarter and end after the quarter.

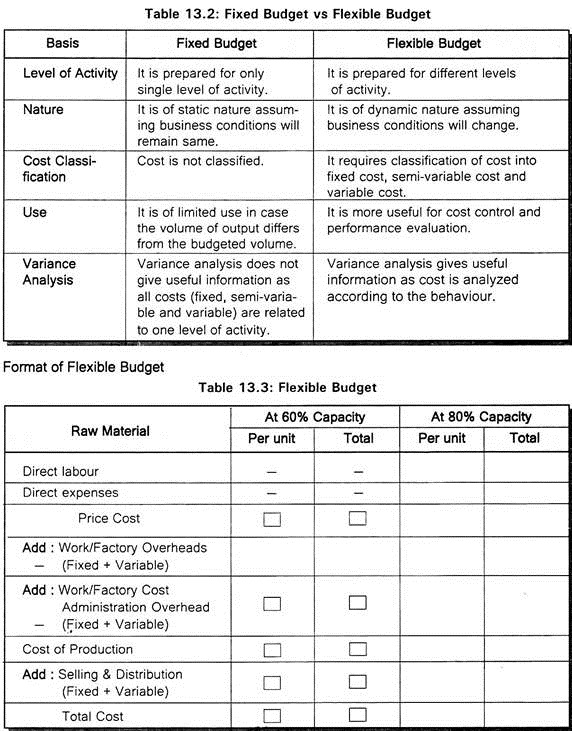

A budget is defined as a comprehensive and coordinated plan expressed in financial terms for the operations and resources of an enterprise for some specified period in the future. Compare actual spending with approved budget doesnt show information on service delivery Supplementary Budgets. Incremental budgeting computes a budget by applying adjustments to the preceding periods actuals.

Produced on monthly quarterly or mid-year basis. Although the terms used to identify the four phases within the. And 6 outcome-focused budgeting.

In determining the period of the short-range budget the following factors should be considered. Capital budgeting for a small scale expansion involves three steps. A sales budget is an estimate of expected total sales revenue and selling expenses of the firm.

4 zero-based budgeting ZBB. MIRR cash flows from year 0 to 4 th year cost of capital rate reinvestment rate MIRR -1000. According to the above definition the essential elements of a budget that average are.

A budget cycle includes the time for planning preparing approving executing and evaluating the budget. It helps to keep track of its income and expenditure. This is a great way to budget for growth.

The incremental budgeting technique uses historic income and expenditure data as a starting point. 1 line-item or traditional budgeting. Its the different phases of budget planning and implementation through different budgeting periods.

It is a forecasting of sales for the period both in quantity and value. Participatory budgeting is a budgeting process that starts with departmental managers and flows through middle management and up to top management. Zero-based budgeting ZBB is a method of budgeting in which all expenses must be justified for each new period.

The budget period should be long enough to cover complete production of various products. The historic data is used as the baseline to formulate the budget for the following year. It is known as a nerve centre or backbone of the enterprise.

Allows government to revise. A business budget typically progresses in phases that in total produce a complete budget life cycle. Cash Budgets A cash budget projects all cash inflows and outflows for the next year.

Organizations within the Department of Health and Human Services use a method of funding for discretionary grants that divides an approved project into funding periods called budget periods. It is the starting point on which other budgets are also based. The budget period should be long enough to allow for the financing of production well.

For business of a seasonal nature the budget period should cover at least one entire seasonal cycle. This data is usually acquired from the previous years budget accounts or a combination of the two. Reflects what government is legally obliged to spend its funds on during budget year In-Year Reports.

Elements of a Budget. The specific time period for operating budget is weekly monthly quarterly half yearly or yearly depending on the convenience of the organization. Budgets are then built around.

Regardless of its focus the budget cycle begins with planning and ends with a thorough evaluation. Adjustments can be made for each budget period so you can adjust the amount each month to increase budgeted totals by a set amount or by percentage. Recording the investments cost projecting the investments cash flows and comparing the projected earnings with inflation rates and the time value of the investment.

Depending on the feasibility of these estimates budgets are of three types -- balanced budget surplus budget and deficit budget. 600 12 14 MIRR 22. This type of budgeting is probably most appropriate for large well-established sports medicine clinics during periods of relative economic certainty.

Generally a budget period depends upon nature and type of business. Variable budgeting this requires that expenditures for any given time period be adjusted according to revenues for the same period. The budgeting process is the process of putting a budget in place.

A budget is essential for any organization. What is zero based budgeting.

Types Of Budget In Accounting 25 Major Types

Diagram Of The Budgeting Process Budgeting Budget Planning Financial Strategies

How To Plan Create Use Budgets Budget Variance Analysis Steps Budgeting Simple Budget Template Budget Template

Excel Paycheck Budget Templateexcel Gift Finance Giftbudget Etsy Paycheck Budget Budgeting Budget Template

Types Of Financial Statements Accounting Education Accounting Basics Financial Education

Types Of Budgets The Four Most Common Budgeting Methods

Budget Cycle Presentation Budgeting Power Point Template Powerpoint Presentation

Electoral Cycle The Electoral Cycle And Its Relation With Budgeting Risk Management Procurement

Creating Your Career Break Budget Budgeting Gap Year Plan Travel For A Year

18 Months Period Budget Templates 7 Free Doc Xls Pdf Budget Template Budgeting Templates

Hospital Operating Budget Template Budget Template Budgeting Organisation Name

Budgeting Process Meaning Approaches Steps Importance

Budgeting Cycle Meaning Importance Phases And More

Explain 5 Techniques Of Capital Budgeting Budgeting Process Budgeting Financial Management

Pin On Awesome And Informative Infographics

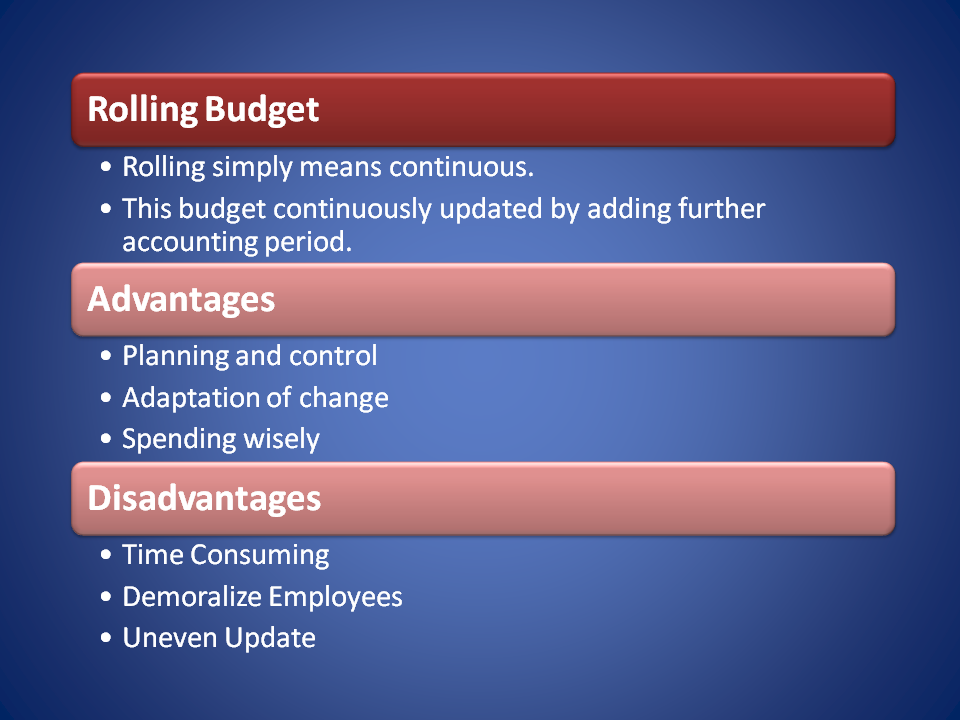

Rolling Budget Continuous Budget Approach Advantage Disadvantage

The Budget Process Camas School District Financecamas School District Finance

Comments

Post a Comment